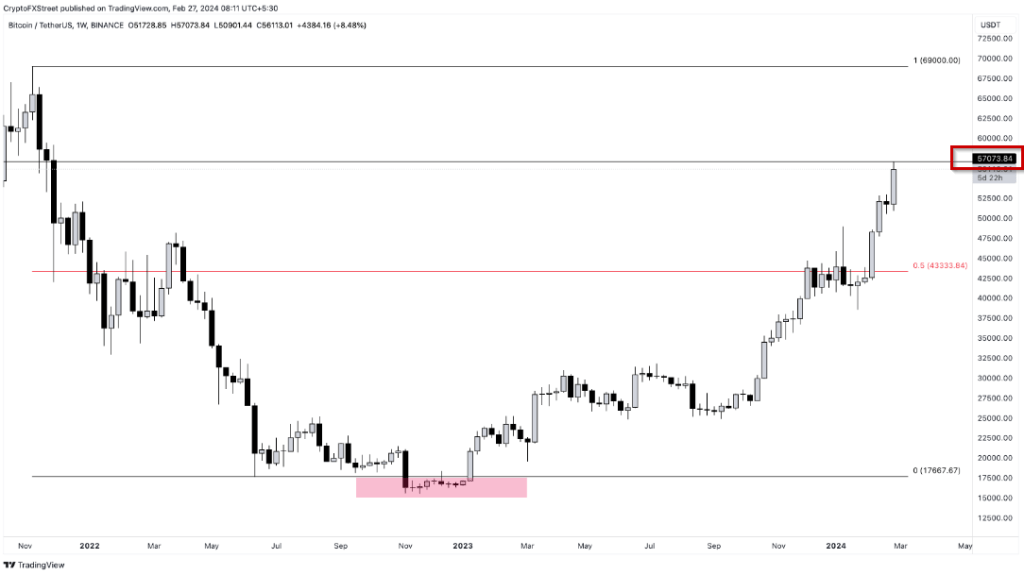

In a not-so unexpected turn of events, Bitcoin (BTC) has surged to new heights, breaking the $57,000 barrier during the early hours of Tuesday in the Asian market. This price level, not seen since November 2021, marks a significant resurgence for the leading cryptocurrency.

Bitcoin ETFs Experience Unprecedented Activity

Remarkably, the surge in Bitcoin’s price has triggered substantial activity in US-based spot Bitcoin ETFs, excluding Grayscale’s GBTC. According to Bloomberg, these ETFs recorded a record-high $2.4 billion in trading volume on Monday. This surge in trading activity underscores the increasing interest and involvement of institutional investors in the cryptocurrency market.

As of the time of publication, bitcoin had slightly decreased to $56,437, but it was still up about 10% from the previous day. Since the beginning of the year, the price of bitcoin has risen by more than 30%, continuing a protracted surge that has also spurred interest in smaller currencies like Ether and Solana, among speculators.

The demand for Bitcoin is not confined to spot trading alone; a substantial influx of approximately $5.6 billion has poured into recently launched Bitcoin ETFs in the US, which began trading on January 11. This influx of investment signals a broadening interest in Bitcoin, extending beyond the traditional base of digital asset enthusiasts.

It’s official..the New Nine Bitcoin ETFs have broken all time volume record today with $2.4b, just barely beating Day One but about double their recent daily average. $IBIT went wild accounting for $1.3b of it, breaking its record by about 30%. pic.twitter.com/MiCs1rzttM

— Eric Balchunas (@EricBalchunas) February 26, 2024

Bitcoin’s Rally Outshines Traditional Assets

Surprisingly, Bitcoin’s rally this year has outpaced traditional assets such as stocks and gold. The ratio comparing Bitcoin’s price to that of the precious metal has reached its highest level in over two years, indicating a shifting preference among investors towards digital assets.

The overall value of digital assets, including various cryptocurrencies, now stands at a staggering $2.2 trillion, a substantial increase from the lows experienced during the bear market of 2022 when the market value dipped to around $820 billion. This resurgence demonstrates the resilience and growing prominence of digital assets in the financial landscape.

Contrary Market Indicators Fail To Deter Crypto Momentum

In an intriguing development, despite a rise in US Treasury yields, which typically signals expectations for tighter monetary policy, the bullish momentum in the cryptocurrency market remains resilient. Digital tokens like Bitcoin are experiencing notable upward movements, defying conventional market indicators.

Fundstrat Global Advisors’ Head of Digital-Asset Strategy, Sean Farrell, noted in a recent statement that the “bullish momentum in crypto is unfolding despite an uptick in rates,” highlighting the unique dynamics influencing the cryptocurrency market.

MicroStrategy Boosts Corporate Bitcoin Holdings

In the midst of this ongoing rally, MicroStrategy, a notable enterprise software firm recognized for incorporating Bitcoin into its corporate strategy, has announced a significant addition to its cryptocurrency holdings.

The company revealed that it had purchased an additional 3,000 Bitcoin tokens this month, bringing its total Bitcoin holdings to approximately $10 billion. This strategic move by MicroStrategy highlights the growing acceptance of cryptocurrencies as a valuable asset by corporate entities.

Featured image from, chart from TradingView