Quick Take

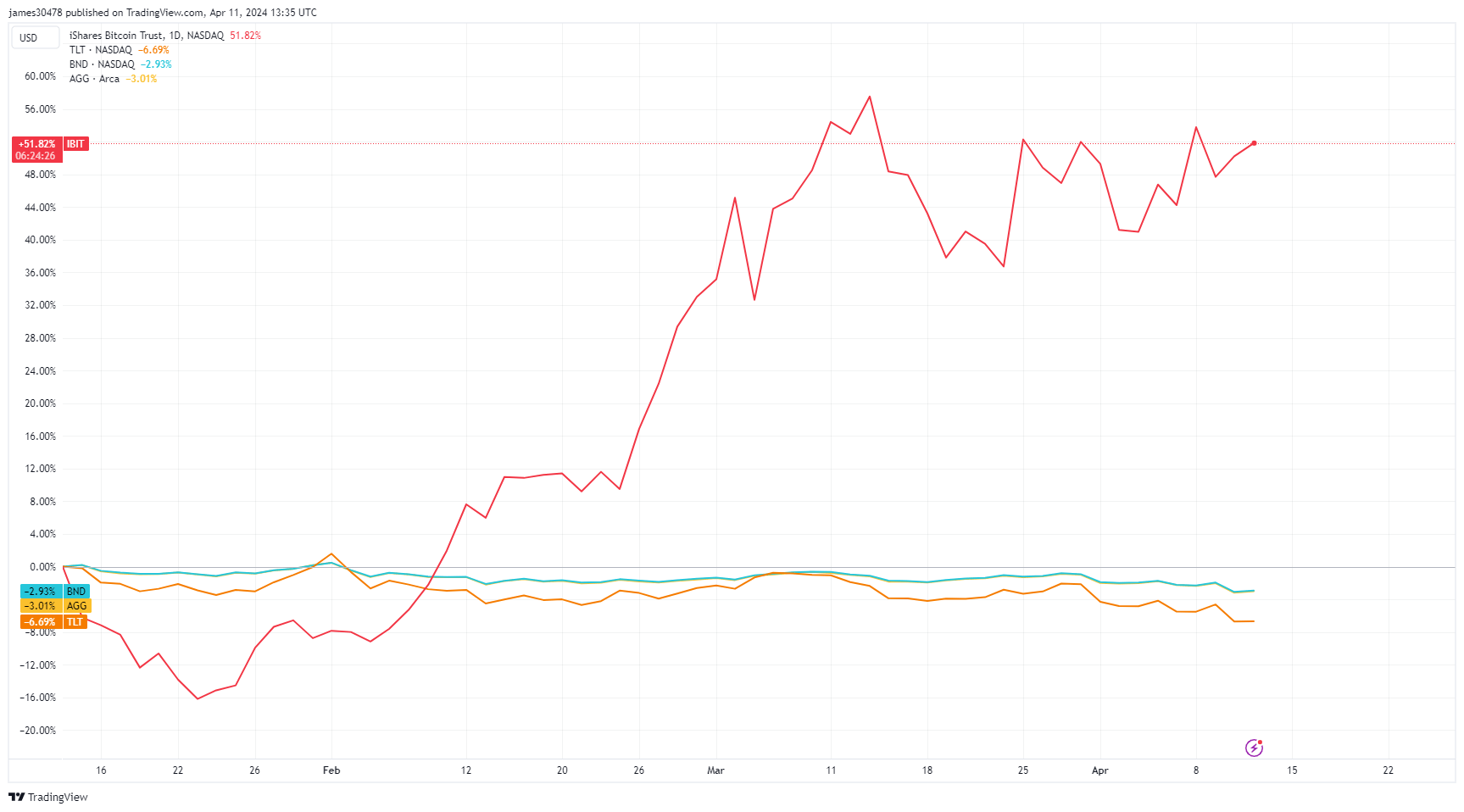

BlackRock’s iShares Bitcoin Trust (IBIT) has taken the ETF market by storm since its launch in January. The ETF now holds an impressive 266,587 Bitcoin, boasting a market cap of approximately $19 billion. With a remarkable 52% year-to-date increase in share price, IBIT has outperformed bond ETFs by a significant margin.

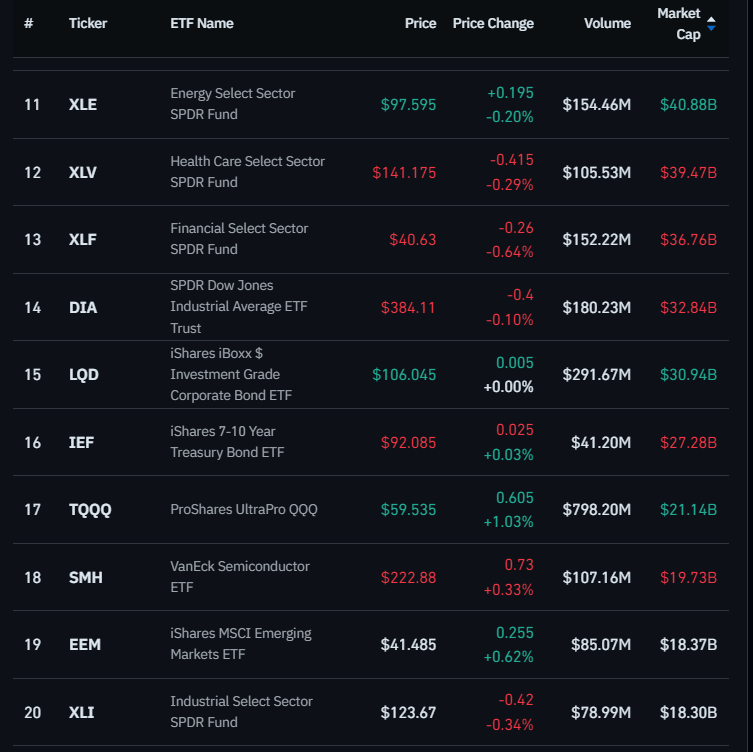

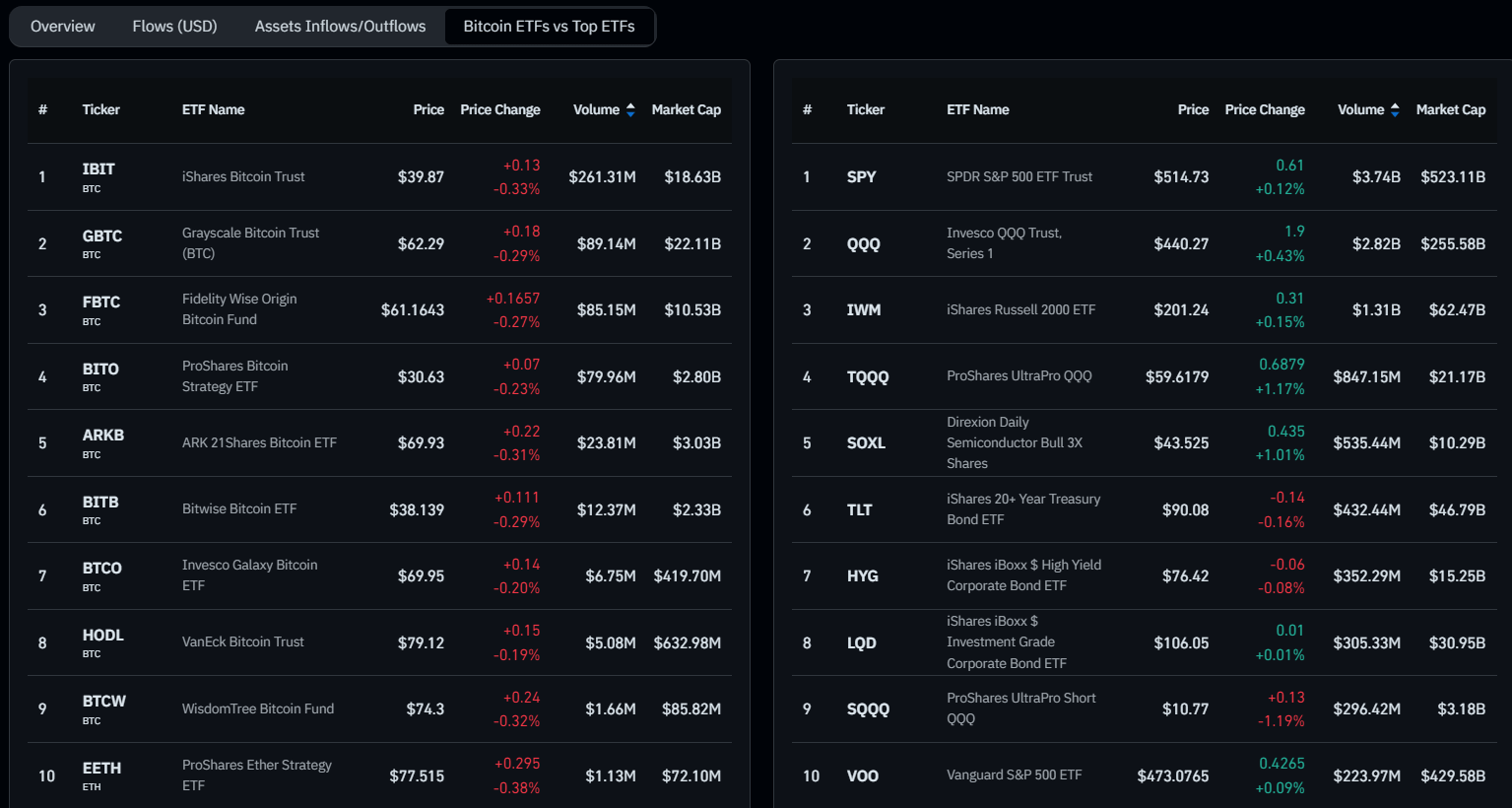

Coinglass data shows that if ranked among other US ETFs in market cap, IBIT would secure the 19th position, nestled between VanEck Semiconductor ETF and iShares MSCI Emerging Markets ETF. IBIT’s volume also speaks to its success, with over $1.5 billion traded on April 10, placing it in the 20th spot compared to other ETFs. Considering market cap and volume, IBIT has solidified its position in the top 20 ETFs.

Data from Coinglass on April 11 shows that within the first 30 minutes of trading, IBIT has already reached a trading volume of over $300 million, positioning it among the top 10 ETFs in terms of volume.

As IBIT continues to break records and with the anticipation of more ETFs launching in Hong Kong and London, the future looks promising for Bitcoin-based investment vehicles.

The post IBIT reaches over $300 million in trading volume within first 30 minutes, entering top 10 ETFs appeared first on CryptoSlate.