Quick Take

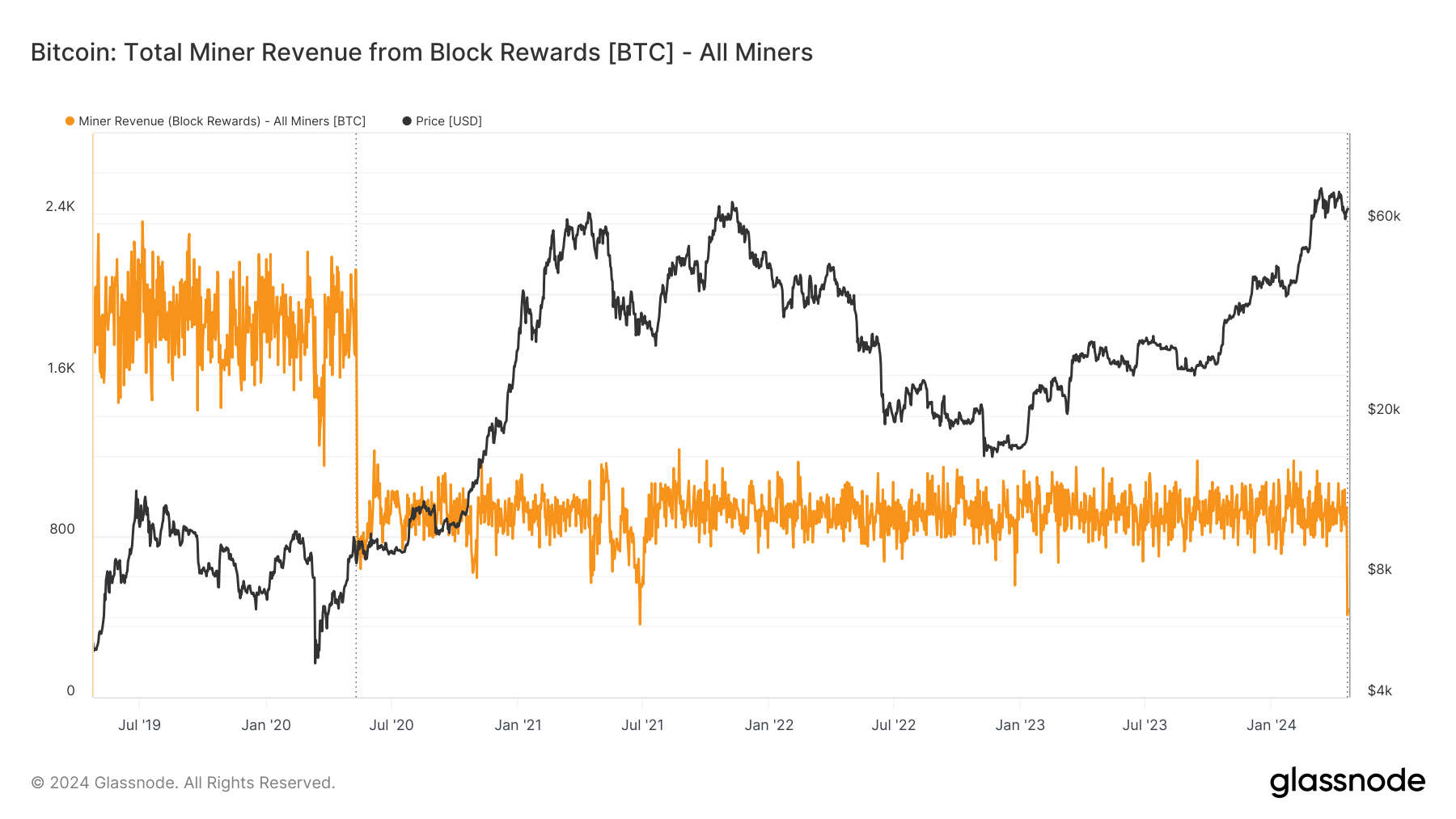

The recent Bitcoin halving has brought significant changes to the mining landscape. The event, which occurs every 210,000 blocks, reduced the block rewards from 6.25 BTC to 3.125 BTC, effectively cutting miners’ revenue from block rewards by 50%.

As a result, the post-halving market conditions have become more challenging for miners.

Prior to the halving, there was a notable run-up in the hash rate, but a correction is expected as unprofitable miners unplug from the network. Currently, miners are being compensated well through elevated transaction fees, but the sustainability of this compensation remains uncertain.

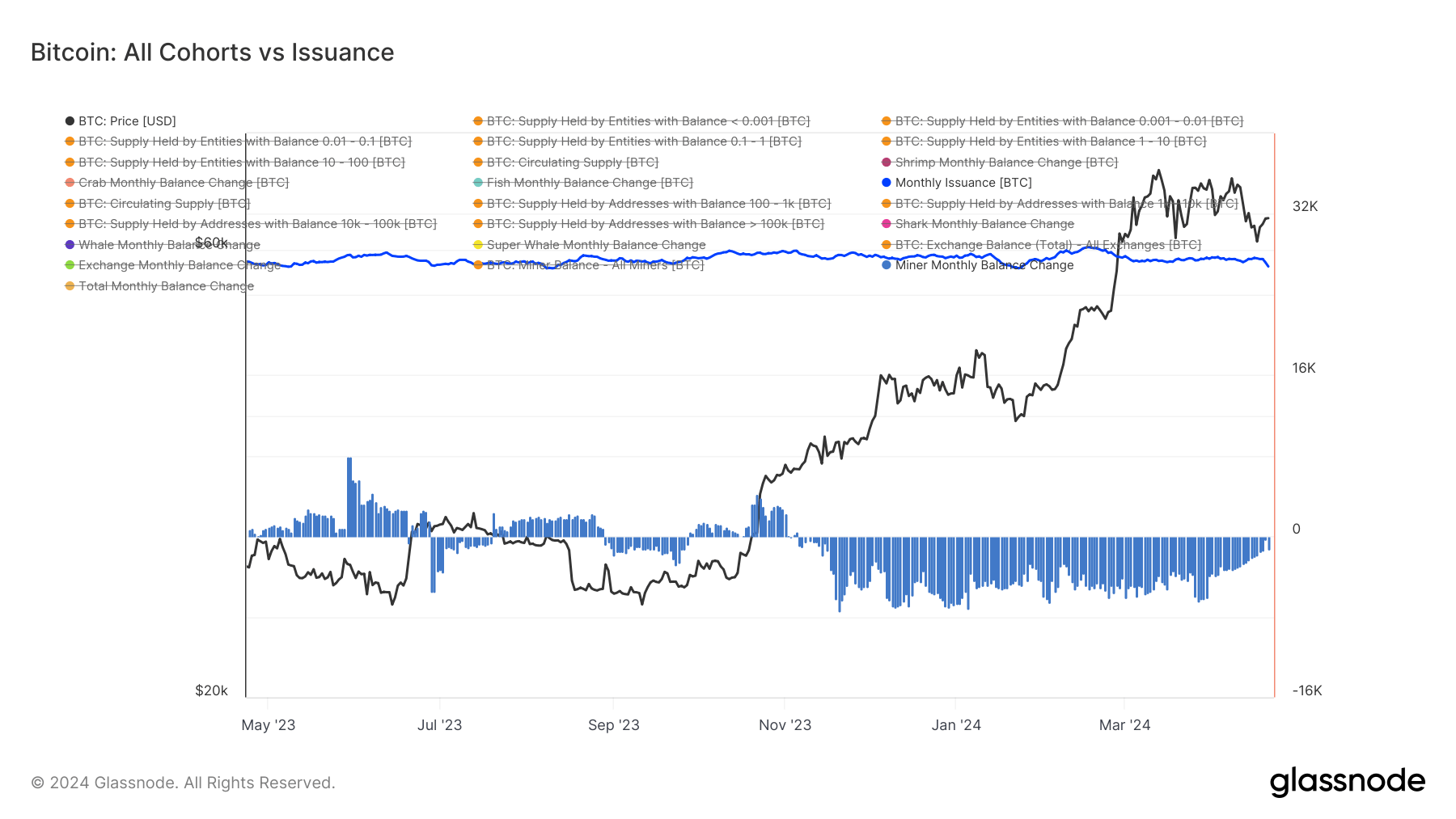

Miners are among the primary entities that are “forced” to sell Bitcoin to sustain their operations. Since November 2023, miners have collectively been selling Bitcoin, peaking at over 6,000 BTC distributed within a 30-day period in December 2023.

However, the distribution trend is dwindling, with the latest 30-day period seeing the smallest amount of selling, with approximately 1,300 BTC offloaded.

As weak and unprofitable miners are purged from the network, the strongest miners survive, and the network consolidates. Miners may not need to sell their mined Bitcoin as much moving forward, potentially reducing selling pressure on the market.

The post Bitcoin sales by miners begin to fall, suggesting a potential reduction in sell pressure appeared first on CryptoSlate.