Fidelity’s Director of Global Macro, Jurrien Timmer, recently commented on the debate over whether Bitcoin or gold is a more reliable store of value, outlining scenarios for when each of these asset classes is or is not able to hedge against inflation based on the economic environment.

The Theory Of Money Supply And Asset Valuation

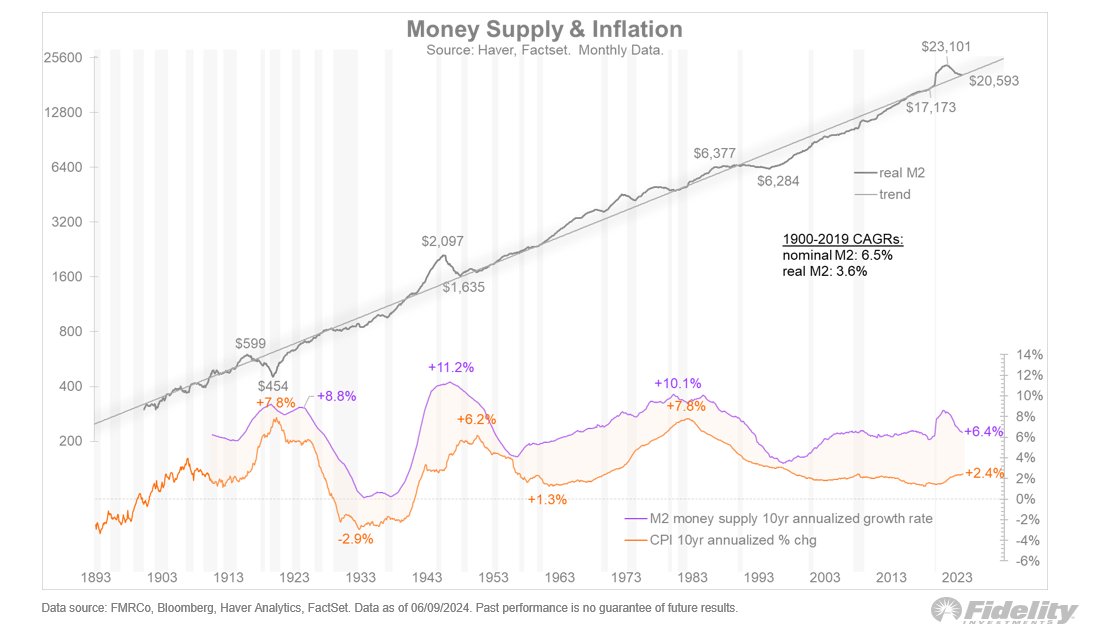

Timmer’s reasoning is built on the concept of “fiscal dominance,” where the government moves to expand the money supply, threatening the purchasing power of the currency. He notes the inflation in the works, as confirmed by the historical M2 money supply/CPI relationship.

And while BTC and gold are arguably the most inflation-resistant assets based on the theory, Timmer believes that such an environment had yet to materialize fully, even after the Federal Reserve’s recent hawkishness.

Furthermore, for the love of volatility, Bitcoin is also called “digital gold,” “gold 2.0,” and “exponential gold” because, on the one hand, Bitcoin has all the monetary items that gold has. Still, it is also a New internet technology, according to Timmer.

However, for Bitcoin to enter and maintain its place with gold, fiat monetary aggregates would have to keep growing for an excessive amount above the normal trends.

While there was a spike in the M2 money supply during the recent pandemic, tightening monetary policy by the Federal Reserve made it short-lived, according to Timmer. This suggests that gold and Bitcoin might be premature in their roles as absolute stores of value.

Currently, Bitcoin’s price has surged to $69,523, following the latest CPI report indicating a slowdown in inflation, which might suggest a strengthening of its position as a store of value.

This report was also reflected positively in gold’s price as the asset could see a 0.91% surge over the past 24 hours with a current trading price of $2,336.

Effects of Treasury Yield Correlations on Bitcoin

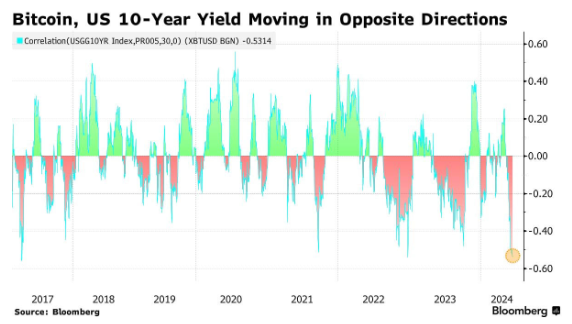

Meanwhile, according to the latest data reported by Barchart, the Bitcoin (BTC) price has lost its correlation with the 10-year U.S. Treasury (UST) bond yield as the correlation has dropped to its lowest level over the last 14 years, equaling -53.

The split signifies that BTC is now progressing independently, without the market being swayed by conventional fiscal instruments such as the yield on S Treasury bonds. This metric determines investor yields in government securities.

This could suggest that Bitcoin is anchored more loosely to traditional financial systems, which could be the beginning of its evolution into a pluck of its unique asset class.

If Bitcoin continues to decouple from these traditional financial metrics, it could greatly enhance its case for being a better non-traditional hedge against fiscal instability.

However, the common limitations of Bitcoin and gold as stores of value, Timmer acknowledges, are based on economic conditions that are yet to play out, especially where the money supply and inflation are concerned.

Featured image created with DALL-E, Chart from TradingView