Quick Take

As of June 28, the final trading day of the quarter, Bitcoin (BTC) has experienced a challenging period, with its value dropping approximately 9% in June. A substantial $6.6 billion worth of options for BTC are set to expire on June 28.

Despite hitting its all-time high in March, BTC has struggled over the past three months, yet it has managed to consolidate above the $60,000 mark, dipping below this threshold only twice and briefly. This consolidation, with BTC correcting around 20% over the past two months twice, demonstrates notable resilience.

As things stand, Coinglass data shows that BTC will end Q2 with a 14% decline, marking its first negative quarter since Q3 2023. Looking forward to Q3, historical trends indicate a strong July for BTC, with the entire quarter expected to be slightly positive based on historical data. However, September typically drags down overall performance due to its bearish nature.

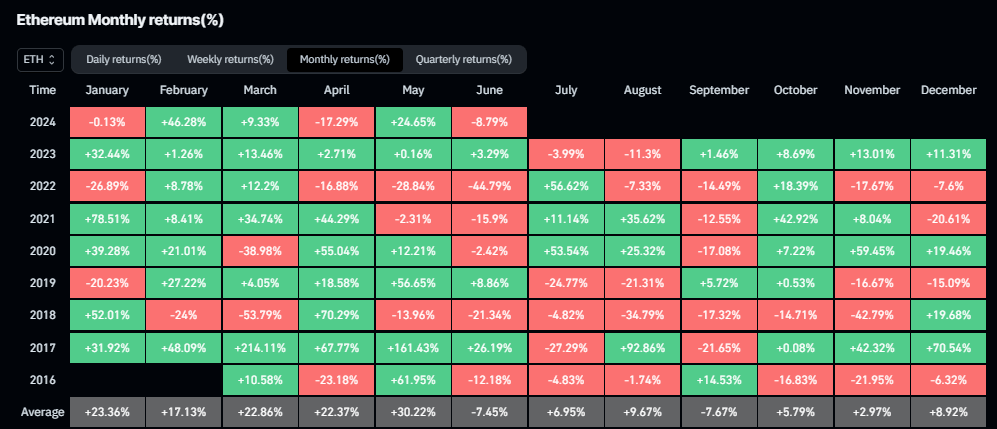

Ethereum (ETH), often seen as a higher beta asset compared to Bitcoin, mirrors BTC’s movements on a USD basis. However, the ETH/BTC ratio highlights Ethereum’s true price strength, showing a 5% year-to-date increase from a low of 15% down in May. With the anticipated launch of Ethereum ETFs in July, there is potential for Ethereum to outperform Bitcoin.

The post Bitcoin suffers 14% decline in Q2, marks first negative quarter since Q3 2023 appeared first on CryptoSlate.