Bitcoin’s halving may no longer have a fundamental impact on BTC and other digital assets’ prices, according to a report by web3 accelerator Outlier Ventures, published on September 3, 2024.

Four-Year Cycle A Thing Of The Past?

Authored by Jasper De Maere, the report posits that it’s time for founders and investors to move past the long-held notion of four-year cycles in the cryptocurrency market, particularly regarding BTC.

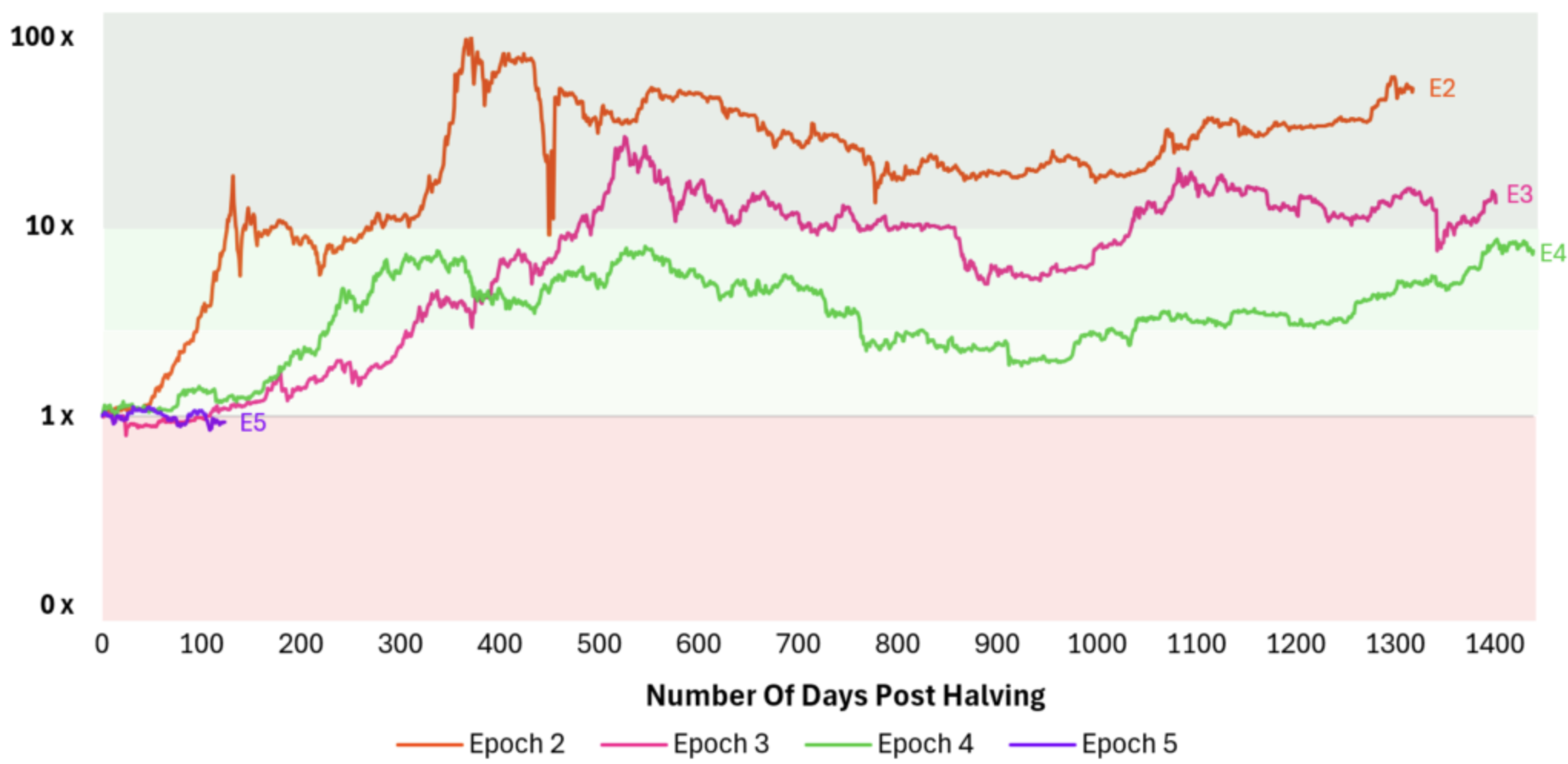

Following the April 2024 halving and Bitcoin’s transition to epoch 5, the leading digital asset is witnessing its worst price performance.

For the uninitiated, Bitcoin mining rewards are halved after every 210,000 confirmed blocks on the network. After April’s halving event, BTC miners’ block rewards were reduced from 6.25 BTC to 3.125 BTC. The period between each halving is called an epoch, and the current epoch will last until the 2028 halving, after which BTC will enter epoch 6.

It has now been over 125 days since the halving event in April, and BTC price is currently down by 8%, compared to a median increase of 22% observed during the same period in previous epochs. If we compare this with Bitcoin’s price performance following earlier epochs, we notice that with each successive epoch, long-term price movements have been weaker than the previous ones.

Per the report, the last time a halving event had a significant impact on BTC’s price was in 2016, during the transition to epoch 3. The potential impact at that time could be explained with the help of the following chart.

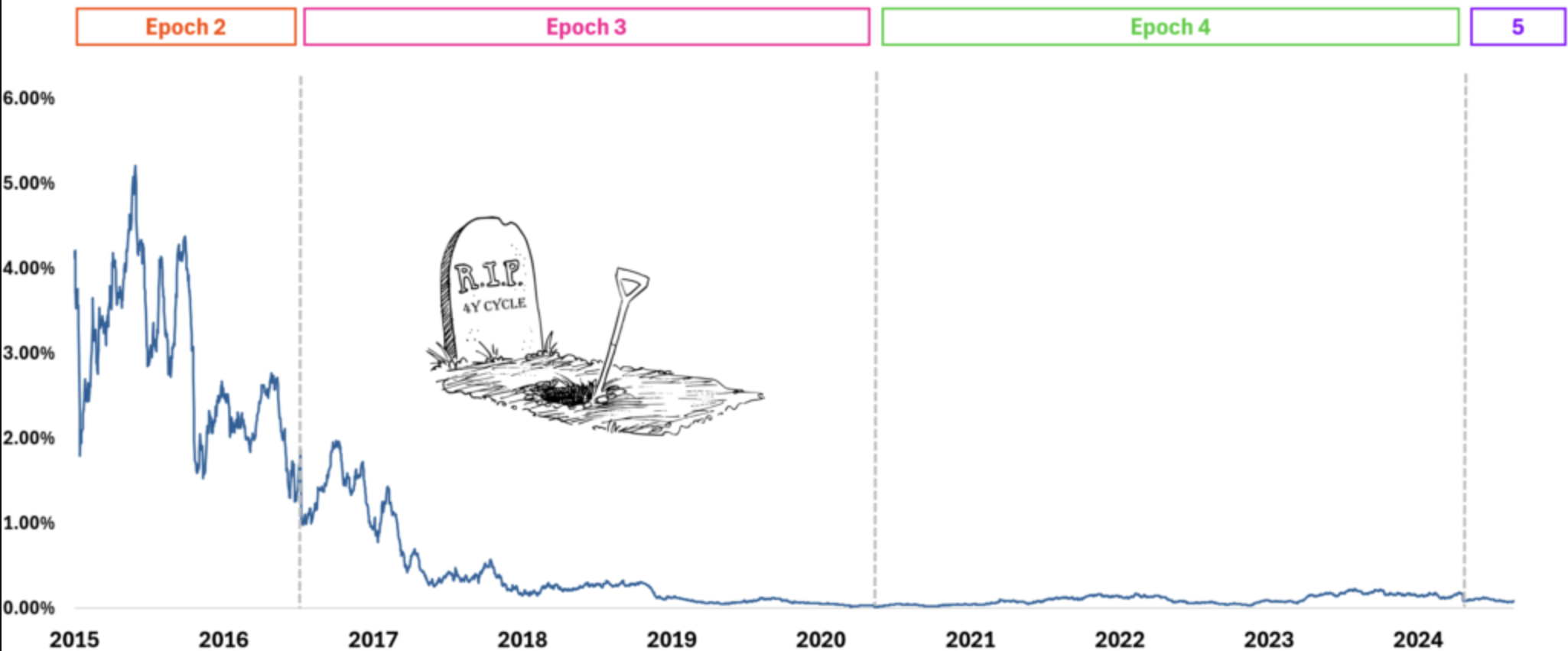

The chart considers the extreme scenario where all BTC miners instantly sell their mining block rewards on the market. The blue line indicates the potential selling pressure on BTC’s price in such a scenario, showing that until mid-2017, such coordinated action by miners could affect BTC’s price by 1%. In 2024, if miners were to sell all their mining block rewards, it would only account for 0.17% of the market volume.

Essentially, the chart demonstrates not only the declining impact of BTC block rewards being sold by miners but also the maturing of the digital assets market.

As for BTC’s positive price action following the 2020 halving, the report mentions that it was largely driven by the massive money printing by central banks around the world in response to the COVID pandemic, rather than the halving itself.

Analysts Still Optimistic On Halving Benefits

While the report by Outlier Ventures doesn’t see the latest halving having any meaningful impact on BTC’s price, other analysts seem to have different thoughts. Seasoned trader Peter Brandt opines that Bitcoin is likely to reach a peak sometime in August 2025.

Similarly, Bitwise, a leading spot Bitcoin ETF issuer in the US, recently made several intriguing predictions regarding Bitcoin’s performance leading up to the 2028 halving, including the possibility of Bitcoin’s price exceeding $250,000.