The post Ripple’s RLUSD Faces Approval Hurdle: What to Expect appeared first on Coinpedia Fintech News

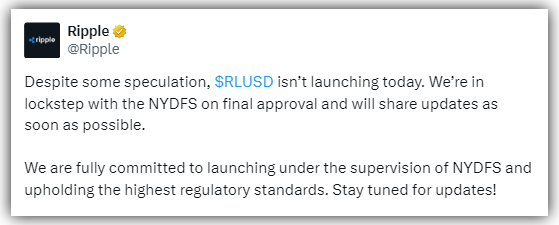

Ripple had big plans to launch its stablecoin, RLUSD, on December 4. But things didn’t go as expected. The company announced on its X account that they’re holding off until they get approval from the New York Department of Financial Services (NYDFS). While this is frustrating for fans of Ripple, the delay might actually work in their favor.

What Makes RLUSD Different?

What’s the deal with RLUSD? It’s not just another stablecoin trying to make a splash. The stable coin is designed to be pegged 1:1 with the US dollar. It will be backed by reserves like actual dollars, short term US Treasury securities and cash equivalents. But here’s the kicker: Ripple’s stablecoin is built to work across two major platforms, XRPL and Ethereum. That’s a big deal. It could open doors for Ripple to play a larger role in decentralized finance (DeFi), where stablecoins are already a critical piece of the puzzle. Ripple clearly wants RLUSD to go head-to-head with the market’s big players, like Tether’s USDT and Circle’s USDC.

Earlier this year, Ripple tested RLUSD on Ethereum and its XRP Ledger, and the results seemed promising. Now, they’re waiting to launch it officially—and that means following the rules in one of the toughest regulatory environments, New York.

Why the Delay Matters

For some people the delay in launch might look like a problem. However, Ripple is very serious about going by the rules. They are waiting for NYDFS approval for their stable coin because they want it to be trusted, not just by crypto people but by institutions as well as regulators.

This careful approach might slow them down, but it could also help Ripple stand out in a market where regulatory compliance is often overlooked. And trust is a big deal, especially when it comes to stablecoins.

Ripple’s Bigger Picture

Ripple isn’t just launching a stablecoin. They are changing how people see the company. For a lot of people, Ripple is only known as the firm behind XRP token. With the launch of RLUSD, they are positioning themselves as a leader in regulated digital finance.

Ripple’s CEO, Brad Garlinghouse, has also been vocal about crypto regulation. He recently supported Paul Atkins for SEC chair, saying the agency needs someone who can bring common sense back to crypto policy. Ripple wants more than just to launch RLUSD—they want to influence how the entire crypto industry grows.

What’s Next?

Sure, the delay isn’t ideal. But Ripple is playing the long game here. If they get the green light from NYDFS, RLUSD could be a real competitor in the stablecoin market. It’s not just about taking on USDT or USDC. It’s about showing that Ripple can thrive in a regulated world.

Ripple’s approach might seem slow, but it’s clear they’re aiming for something bigger. Trust, innovation, and a stablecoin that could shake up the market. The wait might just be worth it.